Overview of S&P 500 Performance in August 2024

The S&P 500, a benchmark index that tracks the performance of 500 large-cap companies listed on U.S. stock exchanges, experienced a volatile yet overall positive month in August 2024. The market’s performance was influenced by a combination of economic data releases, corporate earnings reports, geopolitical events, and shifting investor sentiment.

Key Highlights for August 2024:

- Early August Rally: The month began with a strong rally, driven by better-than-expected earnings reports from several tech giants, including Apple, Microsoft, and Amazon. Positive economic indicators, such as a dip in inflation rates and strong job growth numbers, further fueled investor confidence. The S&P 500 climbed approximately 3% during the first two weeks, breaking through key resistance levels.

- Mid-Month Pullback: By mid-August, however, the market faced a pullback. Concerns over a potential interest rate hike by the Federal Reserve resurfaced after the release of the Federal Open Market Committee (FOMC) minutes, which indicated a more hawkish stance on monetary policy. The announcement caused a 2% decline in the S&P 500, with sectors such as utilities and consumer staples facing the most pressure.

- Late August Recovery: The latter part of August saw a gradual recovery as investor fears eased following comments from Federal Reserve Chair Jerome Powell, suggesting a more data-dependent approach to future rate decisions. This was bolstered by strong retail sales data and a rebound in the technology sector, led by renewed optimism around artificial intelligence (AI) advancements. By the end of the month, the S&P 500 had regained most of its mid-month losses.

- Sector Performance:

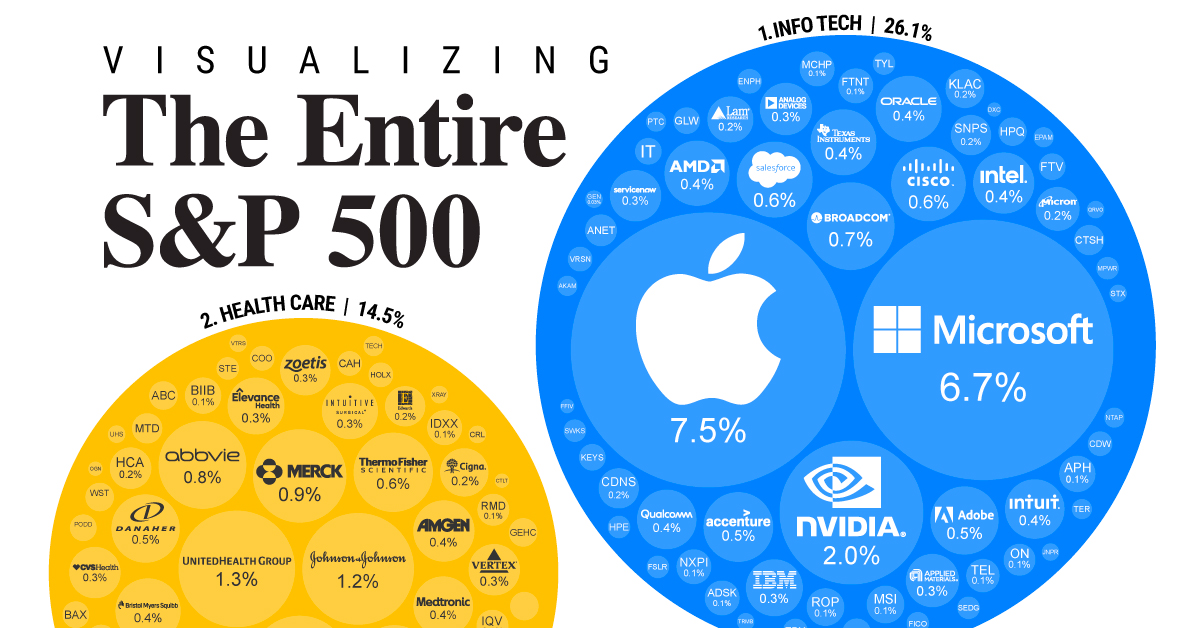

- Winners: The technology and healthcare sectors were the standout performers for the month, each gaining around 4-5%. Investors flocked to tech stocks due to continued innovation in AI and strong quarterly results. Healthcare benefited from positive regulatory news and strong earnings from major pharmaceutical companies.

- Losers: Utilities and real estate sectors lagged behind, posting losses of around 3-4% as rising bond yields made these dividend-paying sectors less attractive.

- Market Sentiment: Overall, market sentiment remained cautiously optimistic. The decline in inflation rates and strong economic data provided some reassurance, but concerns over the Federal Reserve’s future actions kept volatility elevated throughout the month.

Looking Ahead:

As we move into September, the S&P 500 will likely continue to navigate a complex environment. Key factors to watch include the next Federal Reserve meeting, ongoing economic data releases, and geopolitical developments. Investors should be prepared for continued volatility but also look for opportunities in sectors that may benefit from an evolving macroeconomic landscape.

Stay tuned for our next update, where we’ll dive deeper into the factors that could shape market movements in the coming weeks.